Five Generations of Profit Improvement: Corporate Intellectual Growth

This is the dream of immortality. We want our companies and our jobs to outlive us.

Humans are driven inexorably by a biological clock from cradle to grave. Immortality is but a dream. Companies, however, may exist to serve generations of people and thus can reasonably dream of immortality. They are, however, no less fragile than humans and can suffer many ills in the hands of mortals.

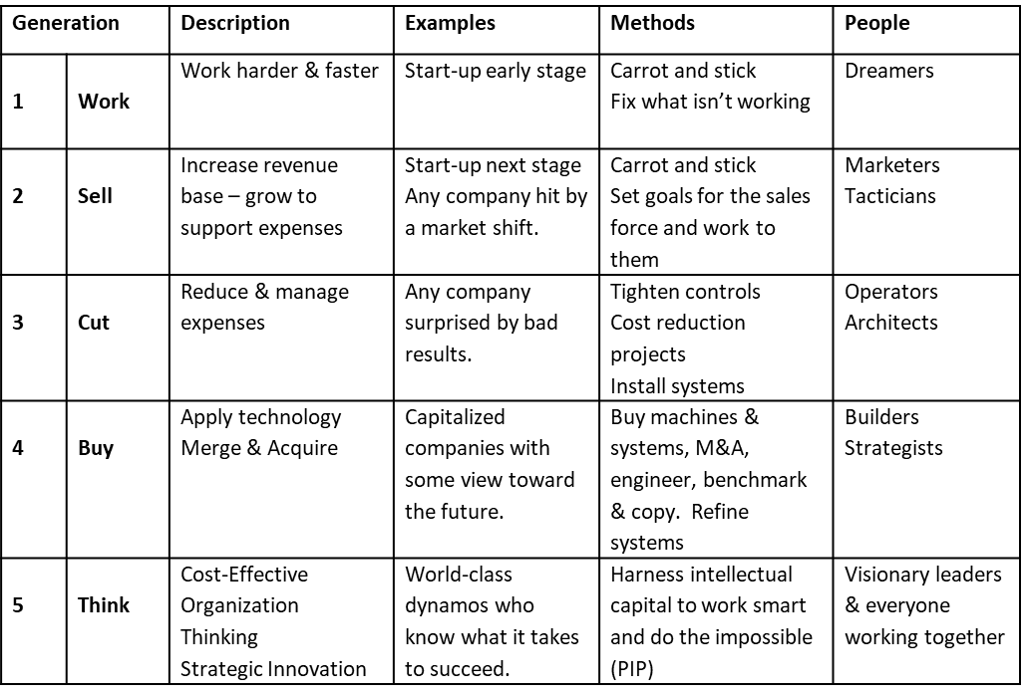

Companies experience five stages of intellectual growth. Given the promise of immortality, I prefer to call them generations rather than stages. The five generational names speak to the focus of the effort of that generation: 1) work, 2) sell, 3) cut, 4) buy, and 5 think. Companies experience elements of each of these generations at all times but are defined by their primary focus at the time. They are not static and can not only grow from generation to generation, but can also regress as their actions, inactions, or the changing environments make a generation obsolete. The table gives a snap shot of each generation and illustrates that a company at of any generation includes a piece of the others within it.

Life is dynamic and so are the companies that populate its commercial world. As individuals grow and mature so do companies. But like people, companies do not always fit in every situation. Sometimes they must change and adapt to survive and prosper. I am often called in to help companies who are either seeking to grow to the next generation or recover a generation they have lost. The measure of success or failure is often seen in the bottom line profitability as a primary measure of long-term corporate value.

Here is a road to success through five generations of profit improvement and corporate intellectual growth.

This table shows the five generations of 1) work, 2) sell, 3) cut, 4) buy and 5) think. Five Generations of Corporate Intellectual Growth

Generation 1 – Work:

Struggling start-ups that may be months or even years old are still locked in to the dreamer’s dream that everything will be all right as long as “We keep our eyes on my dream and work hard.” This is the empire of dreamers and the dream counts more than execution. Leaders at this stage don’t even think about efficiency because that’ll come later. “All we need is a good value proposition and we’ll attract the capital to succeed.” The interesting thing is that in this Dot.Com world, many millionaires are made at this stage even if the company later folds. In the cold reality outside that world, tens of thousands of mundane companies go belly-up under the back-breaking labor of trying to make it work. The interesting thing is that without dreamers the company would not even exist. A failure to grow beyond the dream generation, however, is a sentence of death.

Generation 2 – Sell:

Capital may be getting scarce, investors may be impatient with losses, or the planned growth just isn’t there. Volume is the salvation. This is the domain of the salesman and the marketer. Now it’s time to get out there and sell. “All we need is enough sales to cover the fixed costs and we’ll be rolling in dough.” I’ve heard this from companies in their infancy as well as those that are decades old. The infants never knew any better but the older companies somehow lost their way. Dreamers may still be dreaming but the marketers and tacticians are now playing a bigger role.

Generation 3 – Cut:

The company may be on the verge of success having grown to this point or may have fallen from grace and is now in trouble for lack of satisfactory profits. Capital may have dried up or the stock market may have demoted the stock value. The obvious and immediate way to fix the situation is to improve margins. This is where the operators rationalize the company with rules and systems that impose efficiency. If the situation is dire, they will first cut the fat. They may have no choice but to slash and burn large pieces of the company. Waste, perquisites, products, business units, and, all too often, people may be shed. For companies that see change as a natural part of the ongoing process of evolution, this stage will not be traumatic while the operators work with architects to design a smoothly running machine. For others, that find themselves in trouble, this may be a painful and bloody process. This is where cost reduction projects are often born and dreamers are asked to step aside. Cost reduction more often sets the company back than it helps to move it forward and companies, even those on the Fortune lists find themselves cycling back and forth – stuck in a cutting mentality.

Generation 4 –Buy:

This is the stage when the builders and strategists are creating the company in the current image of the architects and the future image of the strategists. These should be good times. The company is buying machines, systems, and maybe even other companies to create an efficient and effective organization with a strong position in its markets. They will be engineering, bench-marking, and copying the best in class to become the best themselves. For those who continue on to the next stage, life is good. For those who rest on their laurels, life may run them over. The dynamic forces of the rapidly changing world can make a product, strategy, system, or company obsolete in the blink of an eye. Acquisitions can, and often do, fail to deliver on the strategists’ dreams. Companies may find themselves in a position where they are forced back a generation, to cut to survive. The opportunity is to think.

Generation 5 –Think:

Thinking is the key to immortality. A visionary leader knows that change and growth must be integral parts of the corporate culture and operating structure. The power here is the collective intellectual capital of the organization melded together toward a common vision of the future. People are working smart and they work together. Everything they do is tested against the questions of whether or not it fits the strategic plans and is a good investment of the resources involved. All of the energies of the dreamers, marketers, tacticians, operators, architects, builders, and strategists are focused on doing the right things for the corporation. They use all of their vital resources (financial, materials, space, time, knowledge, energy, and people) in a cost-effective manner. They are the Cost-Effective Organizations of the world. They have ongoing continuous improvement programs such as quality processes and the Profit Improvement Process. They prosper through change.

Summary:

Corporate immortality comes to those who harness their intellectual capital to embrace change though continuous improvement. The promise is to think sooner and move more quickly through the generations with diminished trauma and maximum success.

No matter what generation you are in at this moment, you must think of the future and aspire to Generation 5 today to achieve immortality tomorrow. A Profit Improvement Process accelerates intellectual growth. The mindset is vital.

Steven C. Martin

President & C.E.O.

Business Solutions –The Positive Way

Listen to my discussion on this topic with Jim Blasingame, The Small Business Advocate